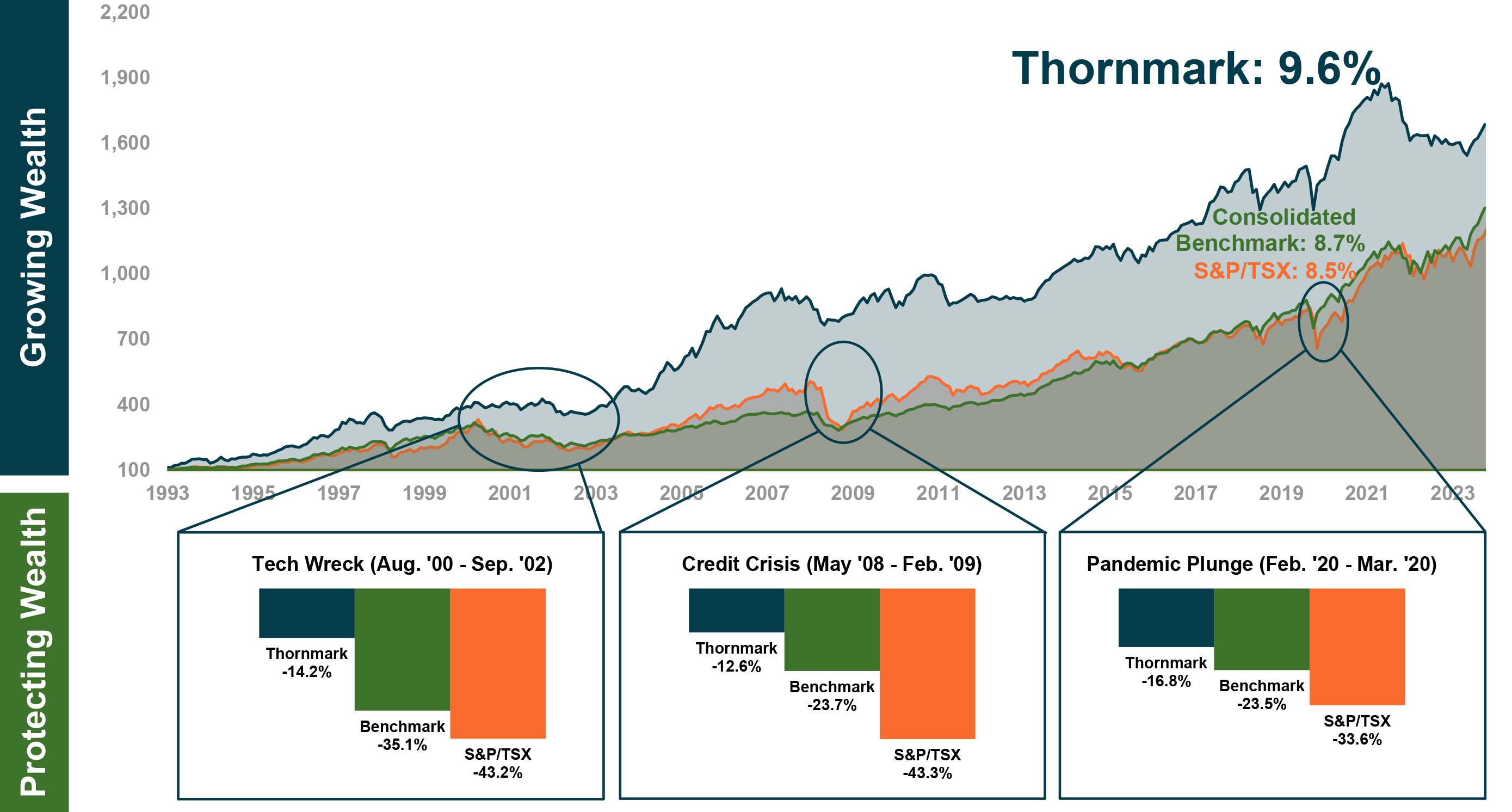

We Help Grow Wealth During Expansions & Protect Wealth During Recessions

Thornmark Consolidated Performance* – May 31, 1993 to March 31, 2024

The Tech Wreck

The 2001 tech bubble resulted in a dramatic stock market collapse. As Canadian tech darling Nortel Networks crashed, many companies folded, and investors’ wealth tumbled. During the Tech Wreck, Thornmark’s tactical investing helped protect our clients from the stock market catastrophe and large investment losses. Thornmark’s Consolidated Performance was down only 14.2%, peak-to-trough during the Tech Wreck. The Consolidated Benchmark declined over 35% while broad Canadian and US stock markets declined by more than 40% from peak-to-trough.

The Credit Crisis

The 2008 Credit Crisis created a severe worldwide recession. From their October 2007 peaks to early March 2009 lows, the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 all suffered declines of over 50% (local currency), making it the worst stock market crash since the Great Depression. In Canada, the S&P/TSX Composite Index lost almost half its value. Again, during this chaotic period, Thornmark’s tactical investing helped clients avoid large losses. Peak-to-trough, Thornmark’s Consolidated Performance was down only 12.6%, a small fraction of the market collapse.

The Pandemic Plunge

On March 11th, 2020, WHO declared the novel coronavirus a pandemic. The global economy was decimated as borders closed and country after country locked-down. The resulting Pandemic Plunge was the fastest equity market decline in history. From the February peak to the March low, all of the S&P/TSX, Dow Jones Industrial Average, and S&P 500 plummetted. In only a month, all the indices lost more than a third of their value (in local currency). During this tragic time, Thornmark’s tactical investing helped clients avoid large losses again. Thornmark’s Consolidated Performance was down only 16.8%, roughly half the market collapse.

Since May 1993, Thornmark’s Consolidated Performance, net of all fees and expenses, outperformed its Consolidated Benchmark and the S&P TSX Composite Index by more than 11%.*

Tactical Investing Works

Thornmark’s tactical investing has worked over economic cycles.* We understand that the pain of losses when markets decline is worse than the joy of gains when they rise. That is why our investment strategies are designed to grow wealth and protect you from large losses.

Investment success isn’t just about simply making money. It’s also about protecting it!

It’s easy to make money in a rising market, but it’s hard not to give it back when the market declines. This challenge means that investment strategies must adapt quickly to changing market conditions.

Our tactical strategies are designed to perform well in both rising and declining markets. Thornmark tactically increases stock exposure (risk) when economies are growing, and reduces risk as markets fall. We pick stocks during economic expansions and use intelligent asset allocation strategies during recessions to tactically mitigate risk. This approach helps to avoid the large losses associated with strategic or index investing, which typically implement only static asset allocations.

We Build Wealth

You Don’t Generate Benchmark Beating Results by Simply Following the Market

We’ve grown client wealth over 25 years through tactical investment strategies, investment performance, and wealth preservation with results that are more than 11% better than the S&P/TSX Composite Index and the Consolidated Benchmark*. This gain was generated while avoiding much of two of the worst market declines since the Great Depression and helped provide our clients with a smoother wealth accumulation experience.

Tactical Investment Math

Thornmark deploys tactical investing strategies designed to grow your wealth during market expansions and help protect you from significant losses during market contractions.

Aversion to large cyclical losses is mathematically intuitive. Large losses are exponentially harder to recoup.

For example, a 15% loss is recouped with an 18% gain, whereas a 50% loss requires a 100% investment gain just to break even and recoup your losses.

After the Tech Wreck, Thornmark’s Consolidated Performance only required a 16.6% gain to recoup investor losses. Meanwhile, the Consolidated Benchmark required a 54.1% gain just to break even. Similarly, after the Credit Crisis, the Thornmark Investment Funds only needed a 14.5% gain to break even while the Consolidated Benchmark required a whopping 31.1% gain to recoup investor losses.

As Warren Buffet says “the easiest way to make money is to not lose it”

Clear Guidance in Complex Markets

Get in touch if you are interested in discussing how Thornmark’s disciplined tactical investment strategies can work for your investment portfolio.

Or send us your details and we will get in touch.